In 2012 I delivered a public presentation called “The History of High Wycombe 2000 to 2100″ in the High Wycombe Guildhall. It was based upon the World Economic Forum’s 2011 assessment of Global Risks. These assess what our world leaders expect the challenges will be, how much each could cost and how likely they are to happen. You can download these terribly dull documents from http://www.weforum.org but I did it for you so you don’t have to. So what’s the big deal?

For starters what is the World Economic Forum? Here’s how they describe themselves: “The World Economic Forum is an independent international organization committed to improving the state of the world by engaging business, political, academic and other leaders of society to shape global, regional and industry agendas.”

To us mere mortals these are the gods of the universe; the people who shape the agenda of the world economy. They meet every year in Davos-Klosters Switzerland to deliberate upon the state of the world. It isn’t just that they are influential.. 40 heads of state will actually attend this year’s shindig between the 22nd and 25th January. It isn’t just that they are important powerful people who we should all listen to. It is that they MATTER.

So when the people who matter wring their hands and worry about stuff it is interesting to know what they are concerned about.. and not concerned about. So I compared what has changed between 2011 and 2014. This is what I found.

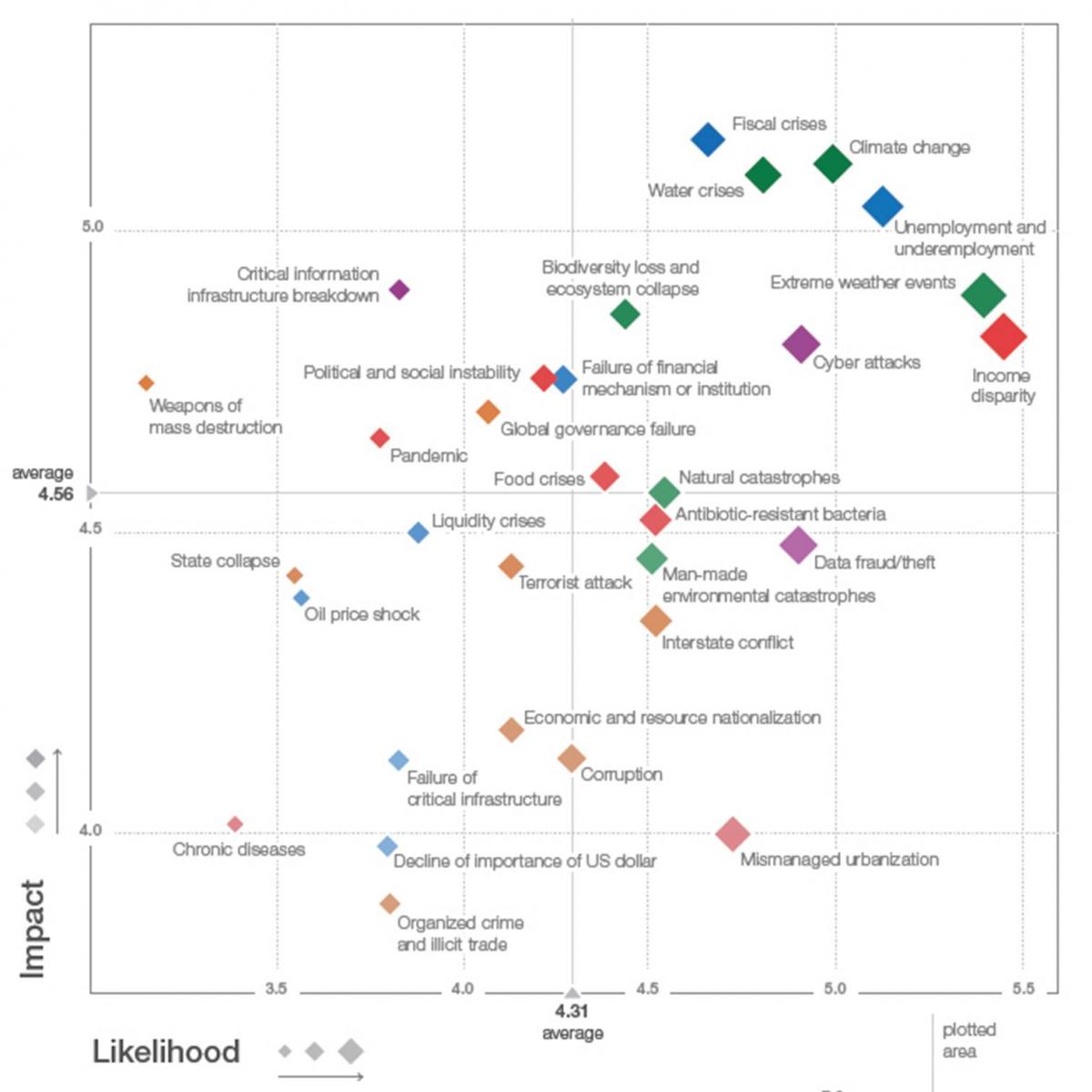

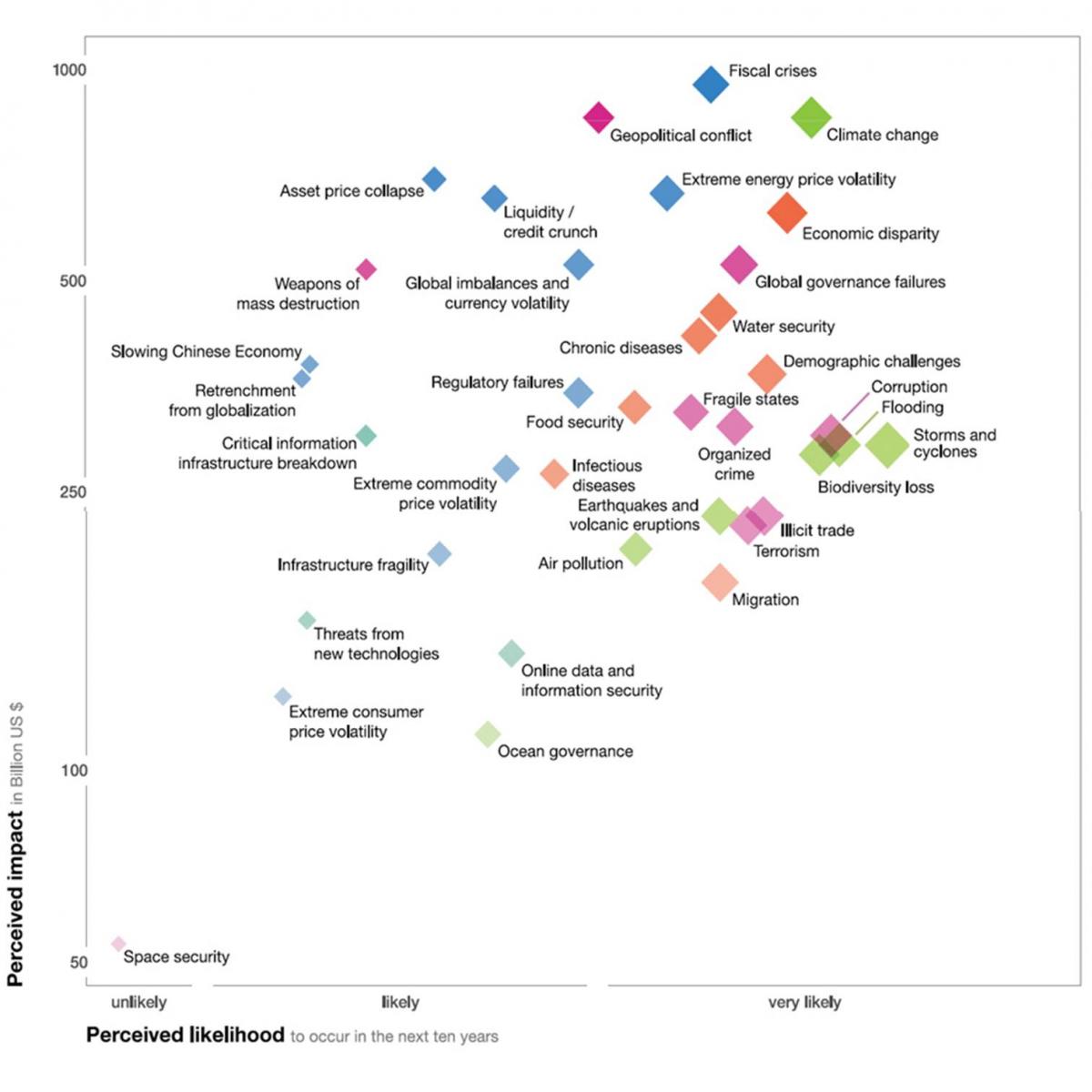

The results of the risk analysis is presented in a simple diagram. The vertical axis represents the impact or cost of a risk whilst the axis going left to right represents the probability of that risk occurring. Have a look at the two diagrams with this blog.

The current four horsemen of the apocalypse are:

◾Fiscal crisis/Unemployment

◾Cyber attacks

◾Climate Change/Extreme Weather events/Water crisis

◾Income disparity

You can see these in an arc at the top right of the diagram above. This area shows the elements that are the most likely to happen and will cost the most.

Back in 2011 the four horsemen were:

◾Fiscal crisis

◾Climate Change

◾Economic disparity

◾Extreme energy price volatility

So the fear of ‘Energy Price Volatility’ has receded considerably in the last three years. Indeed “Oil Price Shock” (the 2014 equivalent) has now been buried somewhere over on the middle-left, ie, not very likely and not very expensive. In comparison the fear of ‘terrorism’ has stayed about in the same place, as has fear of ‘weapons of mass destruction’. The fear of Geopolitical Conflict and Global Governance Failure have faded away which is comforting. The world is more peaceful than it was. However the big boys have stopped caring about the price of energy. Now they worry about cyber attacks. Why?

We probably shouldn’t draw too many conclusions from the graphs – they are only a rough approximation of what is being discussed at the very highest level of Government and transnational business. But there are a few key points. Firstly Climate Change and severe weather hasn’t gone away – not only that but the powers-that-be are acutely aware of it. Unlike the daily discourse in the denial rags there are no governments out there who do not take this VERY seriously. They are talking about it and so should we.

Secondly, fear of a fiscal crisis has not receded. This is quite alarming as we are now 6 years on from the 2008 crash and still bumping along the bottom. Economic growth remain elusive… Rumours abound that this is generally recognised at all levels of governance - even if discussing it is such a taboo that it doesn’t surface.

The third interesting point is the inclusion of unemployment as a metric alongside ‘income disparity’. It may well be the influence of such thinkers as Joseph Stigltiz who have shaped this. Certainly there is now a genuine groundswell of opinion that extreme income inequality among peoples (and not just nations) is destabilising and impoverishes us all.

So why do the great & powerful people care less about the price of oil? The price of oil still remains historically high and few analysts expect this to change. If you want the tar sands out of Canada then it will cost you. However in the last 3 years the global economy has adjusted to the high price. Nobody is expecting another oil price shock soon. The problem is less that oil will be expensive it is more to do with the shock of the change when it happens. The USA has undergone its own fracking revolution that has yielded large quantities of gas and oil for the domestic market. The way America feels about energy security will have a large influence upon the shape of the graph. They represent 25% of the global economy after-all which might slightly skew the results we see. Concerns about energy prices in more local markets have not diminished although there is renewed confidence amongst the oil industry that the fracking technology allows them to increase yield on existing fields.

So what policy statements might we see out of Davos this year? What would be on your wish list if you lead a major western nation? Well the agenda is thus:

◾Disruptive innovation

◾Inclusive growth (“Widening inequality and the declining potency of long-standing growth models raises fundamental concerns around global, regional and industry drivers of prosperity. What models, sectors and industries will generate resilient and equitable growth?”)

◾Society’s New Expectations (“…the widespread erosion of confidence in business and government leaders. What are the necessary steps to orient businesses to the longer term, make governments more accountable and strengthen civic participation?”)

◾A World of 9 Billion (“…escape from destitution by many put high costs on resources and the environment. How can economies embark on a more sustainable path to development?”)

It sure looks like an agenda orientated around the risks. Somehow I find it comforting that global business and governance are sitting down in their thousands to engage each other upon these hot topics:

◾how economic growth impacts resources and environment

◾how economic collapse leads us to question the establishment

◾how business can focus on the longer term

◾how to strengthen civil participation

◾how government can be more accountable

◾how growth can be resilient, sustainable and equitable

I wouldn’t hold my breath for any great revelations or breakthroughs in the Swiss Alps this January. But THEY are talking about what really matters now. Have we turned a corner or is this just a smoke screen? More importantly: can we share the same agenda locally?

Shall WE start talking about these issues too?

This blog reproduced with permission from www.post-carbon-living.com/blog/index.php/2014/01/17/global-risk-update-2014/ where it was entitled "Global Risk Update 2014". You may respond to this blog there or drop us a line on Twitter (twitter.com/TTWycombe) or Facebook (facebook.com/TTWycombe) or via our web site at www.transition-wycombe.org.uk.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereComments are closed on this article